Published 17 November 2016

On the average day, approximately $2.4 billion worth - 2 million tons - of goods move between the United States, Canada, and Mexico. Co-production of world-class products made has given North America an advantage over other regions in the world.

The Trade in Value Added (TiVa) Tool we posted on TradeVistas from the World Bank allows you to explore where value is added to products throughout the world. It might lead you to think that value chains work in one direction: parts are added and the product moves to the next supplier to add their value, whether it’s a design idea, a service adding software, or another part like a touch screen. But in North America, regional production is the norm in our most advanced manufacturing industries.

More than $1 Million Every Minute

On the average day, approximately $2.4 billion worth—2 million tons—of goods move between the United States, Canada, and Mexico. The United States and Mexico alone trade more than a million dollars’ worth of goods and services every minute. Explore how North American trade has grown since the implementation of the North American Free Trade Agreement (NAFTA). NAFTA also made North America a more attractive destination for investment capital from around the globe which grew over 300 percent between 1990 and 2014.

As barriers to economic integration were removed, co-production deepened particularly in technologically advanced goods such as automotive, aerospace, electronics, and pharmaceuticals, which means products like cars begin life as ideas and inputs that move across borders several times before becoming a finished product.

Companies can create regional production platforms and regional supply chains in North America because of NAFTA. They are free to choose the right supplier for the particular task because there are few artificial government barriers to working with partners in the region – standards for their products might be well aligned and tariffs became a non-issue, and it makes good economic sense.

Evolution of a Classic

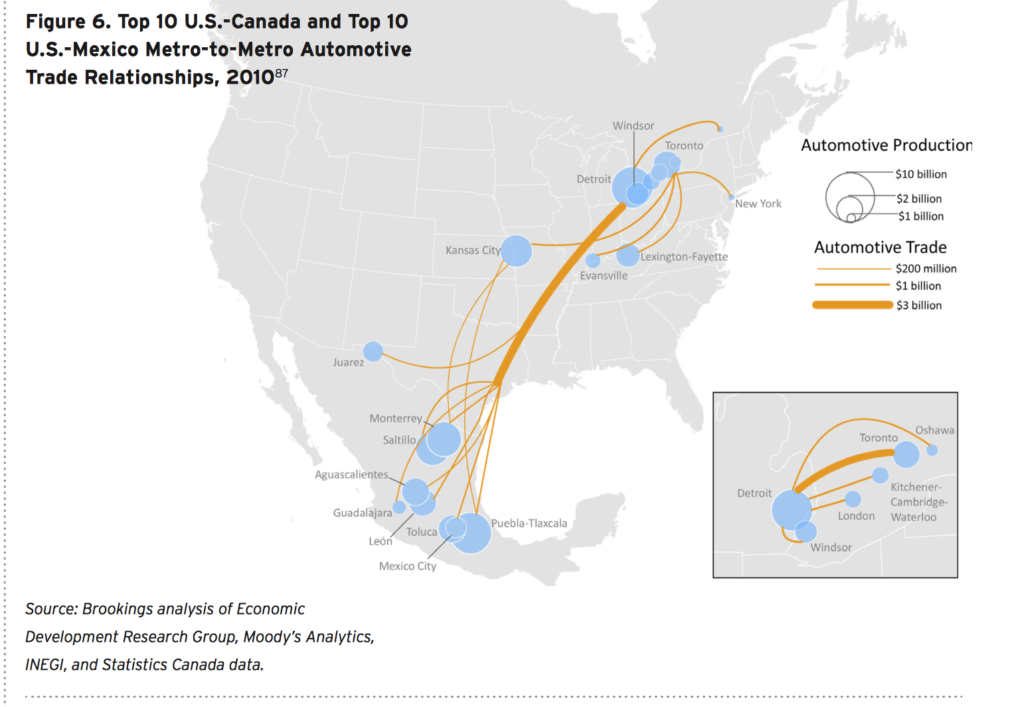

Detroit is still the epicenter of North American automotive industry where significant value is added in the form of research and development. But the physical production of a car is a North American endeavor. According to Brookings research on metropolitan trading pairs, “the large trading volumes between Detroit and Toronto ($3.7 billion) and Chicago and Toronto ($2.9 billion) reflects intensive co-production in the automotive industry between those regions.” Over 30 percent of U.S. automotive component part exports are destined for Mexico, reflecting a similarly deep co-production relationship with Mexico. On average, a car will cross a U.S. border eight times before arriving at the car dealer.

An oft-cited 2011 study on global production chains, “Give Credit Where Credit is Due,” concluded that even more than a decade ago, U.S. imports of final goods from Mexico contained 40 percent U.S. value added. U.S. imports from Canada contained 25 percent U.S. value added.

How Does Co-Production Affect Competitiveness?

The faster products can move across North American borders, the more efficient companies become and the more cost-competitive they become. They are already competing on quality so there’s much to be gained by further reducing logistical costs. It’s not seamless. In the example above, a North American car crosses our borders on multiple times during assembly, which means it has to be cleared by a customs authority each crossing. A vehicle coming from Asia or Europe is fully assembled and inspected only once. So more can be done to achieve maximum efficiencies in the movement of North American goods around the region.

Nonetheless, co-production has already given North America an advantage over other regions in the world. U.S. trade with the rest of the world has grown right alongside of trade with Mexico and Canada, but probably has been boosted because we co-produce many world-class products. The same production sharing practices that make these exports to the world more competitive also serves to minimize the cost of goods consumed in North America—a win-win.

Recommended:

Metro North America: Cities and Metros as Hubs of Advanced Industries and Integrated Goods Trade, Joseph Parilla and Alan Berube

“NAFTA’s Economic Impact,” An excellent and comprehensive NAFTA backgrounder by the Council on Foreign Relations

© The Hinrich Foundation. See our website Terms and Conditions for our copyright and reprint policy. All statements of fact and the views, conclusions and recommendations expressed in this publication are the sole responsibility of the author(s).