Published 10 November 2017

The global production of goods can be charted by each stage at which activity occurs and value is added. The great news is that Americans excel at the activities on the production curve that require the most creativity and know-how, and that generate the most profit.

Getting ahead of the curve

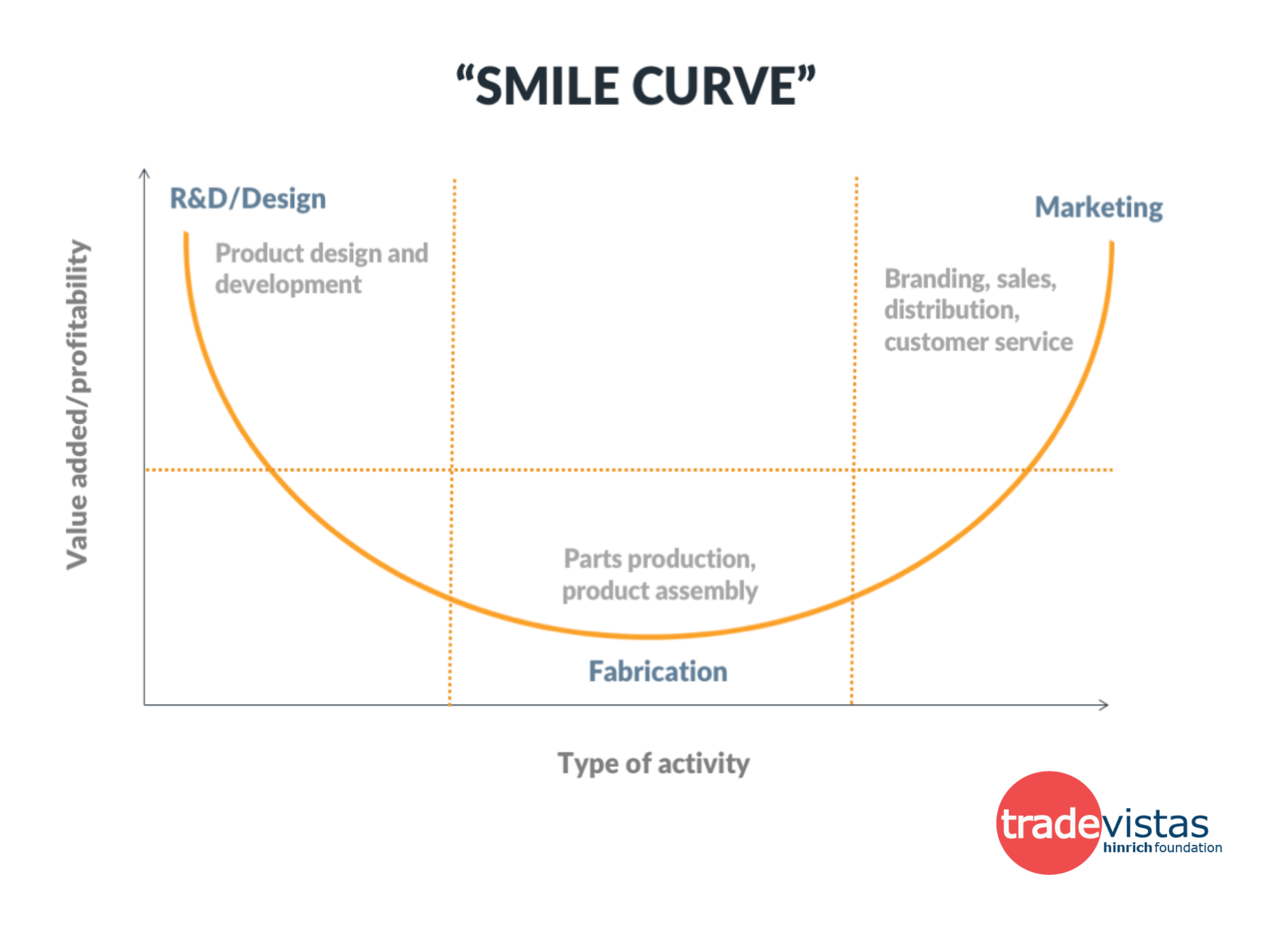

The global production of goods can be charted by each stage at which activity occurs and value is added. The graph takes you on a curve from high-value activities at the beginning of a product’s life, to low-value activities when products are fabricated, to more high-value activities as the product moves closer to the consumer as the product is marketed and distributed.

The great news is that Americans excel at the activities on the production curve that require the most creativity and know-how, and that generate the most profit. We are good at conceiving and developing new products, providing the services that bring them to life, and developing sophisticated approaches to promoting their brands. Our workers and businesses have effectively established a global advantage by organizing multinational production networks, known as global value chains, around their products and then dominating the activities at the top of the curve.

Value is not created equally

Stan Shih is the founder and chairman of Taiwan-based computer giant, Acer. He was a pioneer in the 1970s in the emerging electronics and information technology industries in Asia (along with his wife, Carolyn Yeh). An astute businessman, he’s credited for observing in the early 1990s that more economic value was being added at the beginning and end of global value chains than in the middle where manufacturing and assembly take place.

The activities associated with product development garner market advantage and sustainable sources of revenue. The jobs tend to be knowledge-intensive and better paying. He oriented his business strategies toward strengthening Acer’s competencies in those segments of the computer industry that would generate the most value. His business theory became known as the “Smile Curve”.

Opportunities to move up the curve

Three-quarters of global trade is in the intermediary goods and services that make up parts of the overall production process. Demand for them is driven to a large degree by multinational corporations. Companies build their production networks around reliable business partners who offer what’s needed in each stage of product development, from skill sets to services, technologies, and other assets required.

Information, communication, and transportation costs are so low in today’s economy, companies can find and engage these partners anywhere in the world. Becoming part of a large value chain is one way that firms in developing countries can grow through trade, enabling them to focus on their specialized activity within a global production network. Competing for the business with multinational corporations and working to meet their quality and production standards often helps them take their businesses to next level.

Equally, established suppliers in the United States or in other advanced economies find opportunities to grow their businesses by creating unique value at different points in their customers’ production networks. For example, Intel’s computer processing innovations help drive the marketing and sales of computers based on the quality of their components (“Intel Inside”). 3M in Decatur, Alabama provides touchscreen solutions featured in the marketing of new Apple devices.

China worries about getting stuck at the bottom of the curve

The curve’s shape is influenced by a variety of factors including costs of production. The increased availability of low-wage manufacturing jobs benefited millions of workers in China, but the low-cost advantage can also stifle profits and opportunities for them to move up the curve. Workers in China and other developing economies, covet jobs that require more education and pay better. In China, as in the United States, low-skill jobs are at more risk of being overtaken by technology than by competition through trade. Policymakers worry about a deepening of a curve with fewer jobs at the bottom and a steeper incline to scale.

Some economists think they see “upward commodification” in some industries wherein Chinese firms begin at the base with less advanced manufacturing and then work to flatten the curve on either side through reverse engineering, technology transfer, and standardization of specialized activities. They might also commoditize low-cost product versions to create competitor products that reduce the value of more expensive, innovative brands.

A good example of the limits of anchoring the bottom of the curve is China’s role in producing Apple’s iPad. An iPad assembled in China might be valued around $275 when it is imported in final form into the United States, but the value added and retained in China amounts to just $10. While high-skilled jobs (requiring college education and above) have increased sharply in the U.S. information and communication technology industry generally, around 90 percent of jobs in China’s information and communication technology industry remain low- and medium-skilled. Companies like Apple might source components and contract manufacturing from suppliers around the world, but it keeps the majority of its most valuable professional jobs in-house, including product design, software development, product management and marketing.

Look for the value in everything

Our conversations about trade need become more nuanced. We can’t simply focus on end products to understand how they were made and by whom. They are the culmination of ideas, engineering, materials testing, accounting services, design, coding, sales, farming, and countless others activities by workers who add their value along the way. Chances are you’ll pull a cotton shirt out of your drawer that doesn’t have a Made in USA label, but around 70 percent of its value added was indeed created by American workers. Most every product we use has a complex story.

Every industry is different but it’s clear that global value chains offer opportunities for a wide range of American workers to participate. The question is where do we want to be on the smile curve? Occupying many of the positions at the top of the curve, Americans have plenty of reason to smile about their place today in global trade. Now we need to put in place strategies to stay there.

© The Hinrich Foundation. See our website Terms and Conditions for our copyright and reprint policy. All statements of fact and the views, conclusions and recommendations expressed in this publication are the sole responsibility of the author(s).