Protectionism

Currency Manipulation 101

Published 14 April 2017

Currency exchange rates have affected the terms of international trade since the beginning of floating exchange rates, and for nearly as long, politicians have accused trading partners of manipulating exchange rates to gain an unfair advantage.

Trade and currency exchange

During the 2016 campaign, Donald Trump frequently accused China of intervening in currency markets, and vowed to name them a “currency manipulator” early in his administration. The U.S. Congress requires the Treasury Department (in consultation with the Federal Reserve Board and the International Monetary Fund) to issue a semi-annual report on developments in international exchange rate policies. As it happens, the next report is due April 15. The President has already previewed the administration’s finding that China is not manipulating its currency.

Currency exchange rates have affected the terms of international trade since the beginning of floating exchange rates, and for nearly as long, politicians have accused trading partners of manipulating exchange rates to gain an unfair advantage. What does it mean to engage in “currency manipulation,” how do governments determine whether and when it happens, and what can be done about it?

All sovereign countries manage their currencies

Currency management (or intervention) by sovereign countries is a common practice. A country with an independent monetary policy and free capital flows will hold a reserve of foreign sovereign debt and foreign currency as tools for stabilizing the value of their own currency. Stability is a good thing here—price volatility can be politically and economically destabilizing. A country’s treasury will hold foreign currency to pay for imports or investments abroad, and will also retain sufficient reserves to allow them to stabilize their exchange rates—buying and storing foreign assets to slow the rise of their currency, and selling them to purchase their own currency as a cushion when its value is declining.

When management becomes manipulation

The U.S. Congress has defined exchange rate “manipulation” through a three-part test. A trading partner that 1) has a significant bilateral trade surplus with the United States, 2) has a material current account surplus, and 3) engages in persistent one-sided intervention is considered to be engaging in currency manipulation.

In April 2016, the Treasury Department created a “monitoring list” of major trading partners that merit attention based on these three criteria. The six major partners are China, Japan, Korea, Taiwan, Germany, and Switzerland. China met two of the three criteria in April 2016 and October 2016—a large bilateral trade surplus and a current account surplus above 3 percent. Interestingly, the other five economies also met two of the three criteria, although not always the same two. The Treasury Department concluded that no major U.S. trading partner was manipulating its currency against the U.S. dollar. In fact, Treasury has not cited a country for currency manipulation in over two decades.

The U.S. Treasury Department has not cited a country for currency manipulation in over two decades.

Campaign promise, meet reality

China looms large in discussions of currency manipulation, and understandably so. It is the number two trading partner of the United States, it has a persistently large current account surplus with us, and its exchange rate practices are somewhat opaque. However, there has been a dramatic change from a decade ago.

China’s overall current account surplus has declined from 10 percent of GDP to around 2 percent today; the Chinese RMB’s real effective exchange rate has appreciated more than any other country in Asia; and China’s foreign reserves have declined from nearly 50 percent of GDP to around 25 percent. At present, China’s actions in the currency markets are attempts to increase, not devalue, the RMB. Here’s a key passage from the Treasury Department’s October 2016 report: “…from August 2015 through August 2016, China sold more than $570 billion in foreign currency assets to prevent more rapid RMB depreciation.”

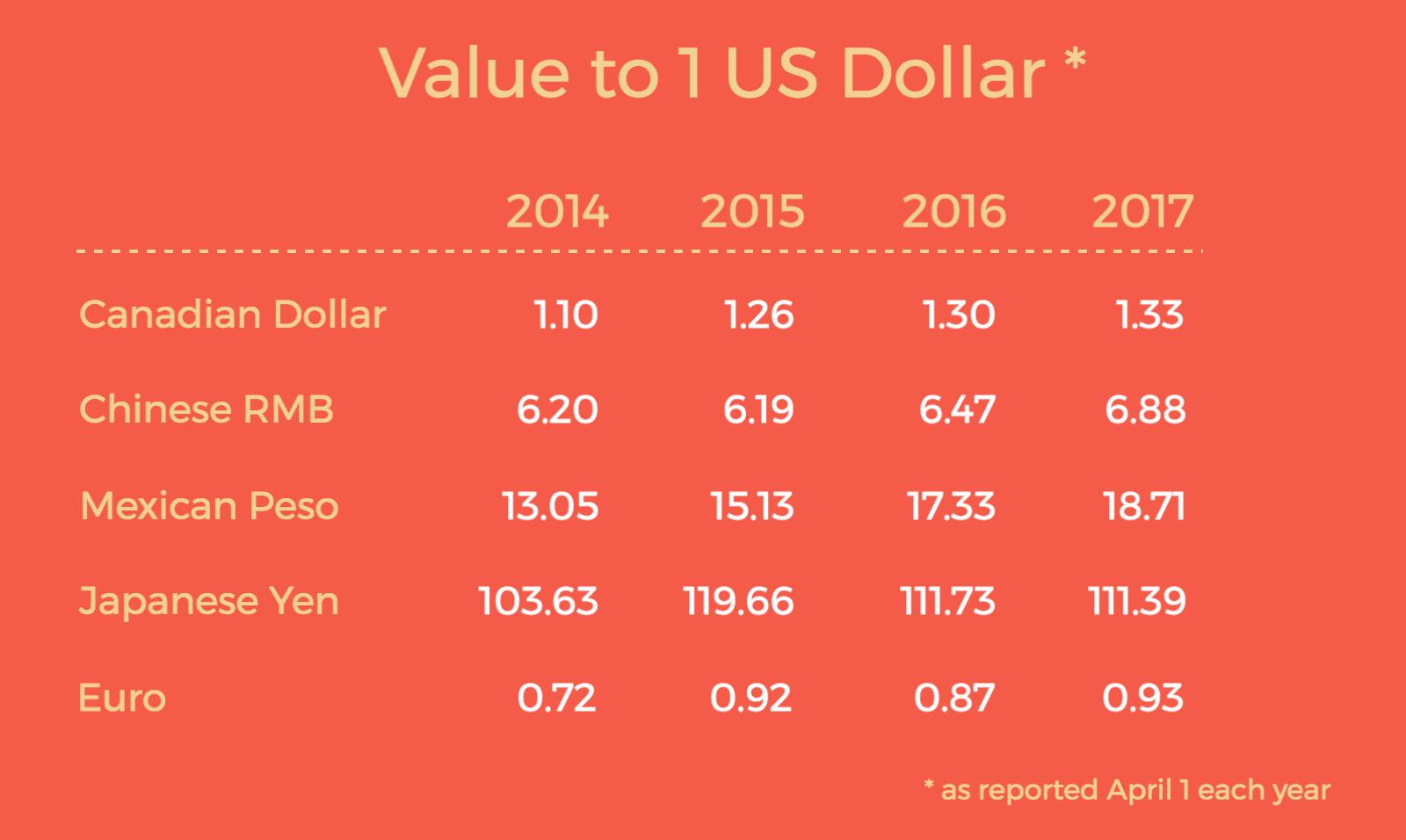

Now let’s compare China to other large trading partners. About 2/3 of all U.S. trade is with five partners: Canada, China, Mexico, Japan and the European Union. The table below shows exchange rates for each partner today, and one, two and three years ago.

So, over the past three years, the Peso has depreciated by 43 percent, the Canadian Dollar by 21 percent, and the Euro by 29 percent. The Japanese Yen and Chinese RMB showed only modest change, depreciating by 7 percent and 11 percent respectively.

Surprised? Don’t be. Big moves for the Canadian Dollar and Mexican Peso reflect the important role of commodity prices in their exchange rates. Meanwhile, the dollar strengthened versus the Euro due to differential growth rates and monetary policy divergence—the European Central Bank continued “quantitative easing” at a time when the U.S. Federal Reserve Board began moving toward raising interest rates.

Trading relationships are about more than currency

It’s certainly true that countries manage their exchange rates and can intervene to support their export sector. In fact, the Swiss National Bank pegged the Swiss Franc to the Euro in 2011 when its currency was rising fast enough to threaten its exporters (trade is 70 percent of Swiss GDP). The peg held until 2015, mainly because printing Francs became a domestic political concern and the European Central Bank’s policy was pushing the Euro down (making the “peg” costlier for the Swiss to maintain).

That said, as the table above illustrates, most currency moves are not “manipulation.” The U.S.-China economic relationship is deep and complex, as you would expect from interactions between the world’s largest traders. At present, currency is a smaller factor. Trade and finance officials are right to move past findings of “manipulation” to focus on other matters of concern.

© The Hinrich Foundation. See our website Terms and Conditions for our copyright and reprint policy. All statements of fact and the views, conclusions and recommendations expressed in this publication are the sole responsibility of the author(s).